GGFI 1: Methodology

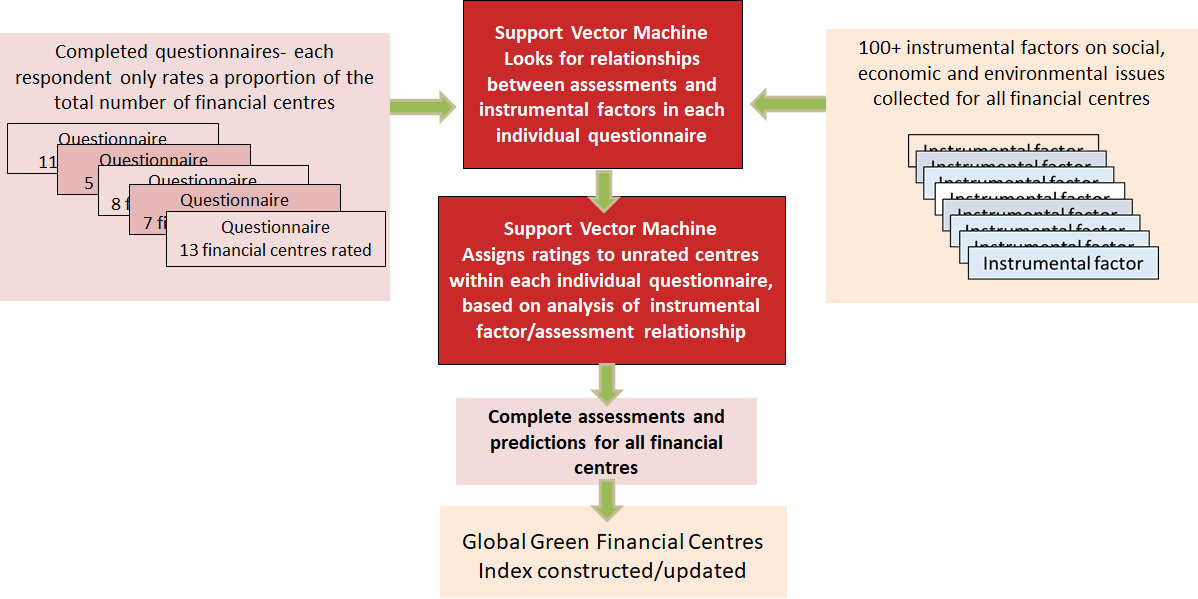

The Global Green Finance Index (GGFI) 1 assesses ratings for financial centres calculated by a ‘factor assessment model’ that uses two distinct sets of inputs:

- Green financial centre assessments: evidence of how the depth and quality of financial centres’green finance offerings are captured through an online questionnaire.

- Instrumental factors: objective evidence of both environmental credentials and green finance sought from a wide variety of comparable sources (Click here for details). For example;

- information on how a given financial centre’s activity contributes to lowering carbon dioxide/GHG emissions;

- evidence of a financial centre’s commitments and achievements on ESG disclosure,

- information about the trading and regulatory environment of green finance, for instance volume trades in carbon or green bonds,

- global data such as the Ease of Doing Business Index (supplied by the World Bank), the Government Effectiveness rating (supplied by the World Bank) and the Corruption Perceptions Index (supplied by Transparency International).

Not all financial centres will be represented in all the external sources, and the statistical model will take account of these gaps.

For the first edition of GGFI, analysis has been carried out on a range of financial centres across the world. Responses were collected via an online questionnaire which runs continuously. A link to this questionnaire is emailed to our growing list of respondents, which includes green finance professionals and experts, at regular intervals.

In order to avoid home centre bias, the centre where a respondent is based in is excluded from the assessment.

The financial centre assessments and instrumental factors are used to build a predictive model of green financial centres using a support vector machine (SVM).

SVMs are based upon statistical techniques that classify and model complex historic data in order to make predictions on new data. SVMs work well on discrete, categorical data but also handle continuous numerical or time series data. The SVM used for GGFI provides information about the confidence with which each specific classification is made and the likelihood of other possible classifications.

A factor assessment model is then built using the centre assessments from responses to the online questionnaire. The model predicts how respondents would have assessed centres with which they are unfamiliar by answering questions such as:

If a respondent gives Singapore and Sydney certain assessments then, based on the instrumental factors for Singapore, Sydney and Paris, how would that person assess Paris?

Predictions from the SVM are re-combined with actual financial centre assessments (except those from the respondents’ home centres) to produce the GGFI – a set of green financial centre ratings of green finance penetration and quality.

Over time, GGFI will be dynamically updated, either by updating and adding to the instrumental factors or through new green financial centre assessments. These updates will permit, for instance, a recently changed low carbon index to affect the rating of the centres.

The process of creating the GGFI is outlined diagrammatically below:

The strengths of this approach are:

A wide range of indices can be used for each instrumental factor;

- A strong international community of respondents can be developed as the GGFI progresses;

- Sector-specific ratings are available using the business sectors represented by questionnaire respondents. This makes it possible to rate a centre as highly influential in carbon trading (for example) whilst less advanced in enhanced analytics (for instance).

- The factor assessment model can be queried in a ‘what if’ mode - “how much would London carbon emissions costs need to increase in order to enhance London’s ranking against Singapore?”

Part of the process of building the GGFI will be sensitivity testing to changes in instrumental factors, the refining of the questionnaire, the development of the rating community and testing of the accuracy of predictions given by the SVM against actual assessments.